Integrate living income interventions into coffee-buying practices

As the coffee industry prepares to meet in Copenhagen for the World of Coffee event, last week’s Living Wage & Income Lab seized the opportunity to highlight a crucial topic: integrating living income discussions into coffee sourcing practices. Valuable insights were shared by representatives from Volcafe and its subsidiary Molinos de Honduras, The Coffee Quest, MVO Nederland, and Fairfood’s new partner, Heifer International. This diverse panel outlined two critical steps forward: determining what and who is needed to establish prices that cover the true costs of coffee production, thereby future-proofing small-scale farms.

If you missed the session, we now explore four key discussion points that we hope to see taking the stages during this significant week for the coffee industry.

First, a few numbers

A study by Solidaridad and IDH published just two days before this session set the tone of the conversation: the coffee industry’s current economic model is not viable.

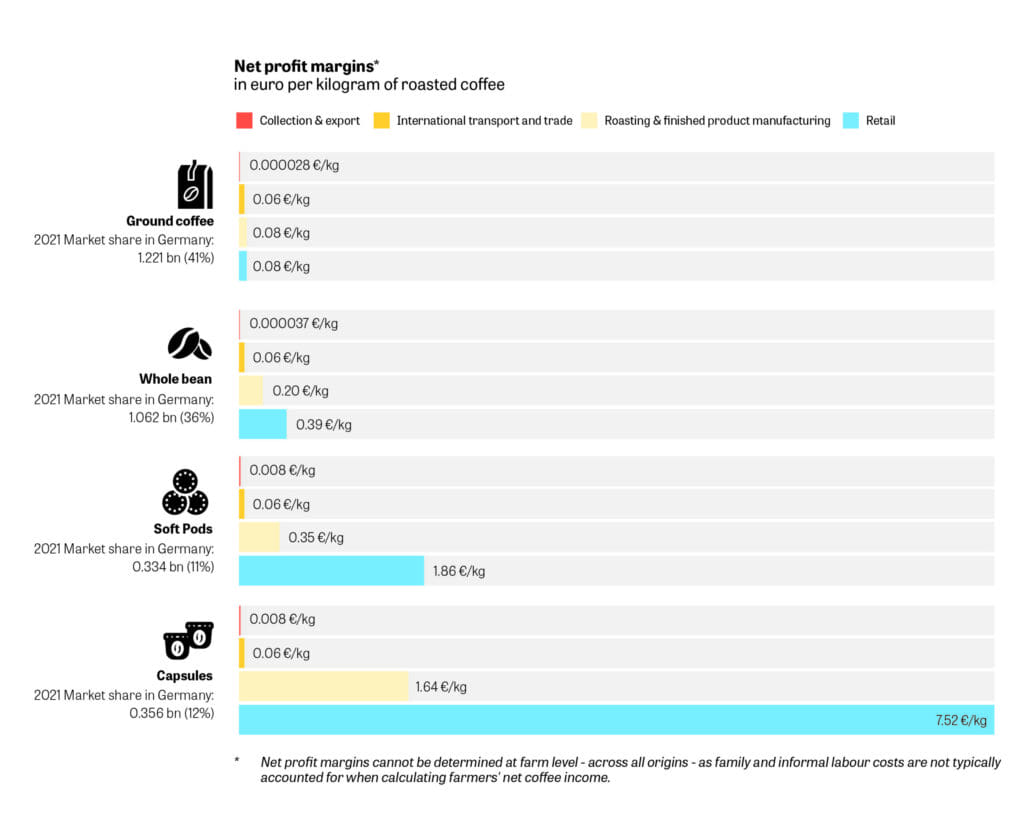

- Value Distribution: The research used the German coffee market to estimate value distribution, showing significant value creation rarely reaches farmers.

- Profitability: Profitability varies widely among downstream actors, but there is no increase in value at the coffee cultivation stage.

- Value Drivers: Marketing and brand image, rather than origins or flavors, are the second-largest drivers of value creation.

With underpayment rooted in most risks faced by the sector, the disconnect between the value created at the consumption level and what reaches farmers underscores the urgent need to establish mechanisms for value to trickle down.

If the customer is king; regulation is our catalyst

The panel echoed the study’s findings: the client defines traders’ goals—whether a roaster, a brand, a retailer demanding, or not, fair prices for farmers. New laws were welcomed for steering the industry towards sustainability. Despite the focus now being the deforestation regulation, a living income was highlighted as a human right within the Corporate Sustainability Due Diligence Directive (CSDDD), soon to be adopted by EU member states. Panelists are curious, although still in the dark, on what a living income process could look like in practice.

“If we were able to agree on comparable values, and tools to measure carbon footprints, a similar approach is needed to address underpayment and handle the ‘politics in the field.’ For instance, clients committed to paying premiums to the percentage they source from, can create income disparities within a community,” one of the panelists shared. Coffee companies still rely on NGOs and Governments in terms of funds and assessment, making the current model unsustainable; When it comes to tooling, making a living income path tangible for downstream partners seems to be the place to begin with.

The data-backed road to a living income

Demand for data is rising, yet without a structured framework in place, this effort risks burdening already strained first-mile actors. Examples such as income surveys, technician training, software expenses, and staff travel to farms illustrate the financial, time, and personnel investment involved in this ambition. At origin, cutting intermediaries or adopting voluntary certifications were listed as cost-reduction efforts.

Following a project initiated 2 years ago, Fairfood and Molinos de Honduras are now leveraging traceability data to inform an ambitious set of living income interventions, in collaboration with Heifer International. Together, the two organisations have developed a Living Income Pricing methodology that enables them to collect data and segment farmer groups based on their levels of efficiency, and are now co-designing interventions to address the inefficiency and quality gaps. “Identifying the gap between the living income price and the market price will help us address systemic issues like migration and youth disengagement from the rural economy, which stem from the lack of profitability in farming. With this partnership, we don’t intend to pursue a single intervention area, but to have the data to tailor intervention strategies based on the reality of the specific supply chains. Only then we can ensure more transparent conversations about the necessity of these interventions in the first place.”

Farmers: The missing partners

Even with precise figures and exact living income calculations, price alone cannot and will not resolve the fact that small-scale farmers cannot rely on a single commodity. Despite consistent themes and strategic focus areas, you still need to hyper-localise the intervention strategy for each specific country and value chain. Most importantly, farmers must be involved at each step of the process: it could be a cooperative, a union of cooperatives, or local community groups and their leaders—it’s really context-dependent. “This is where you can’t assign a strategy; you really have to understand what are the leadership structures within a community and what’s the best way to advocate for this kind of process. This assessment must be part of a project structure, and that’s where long term relationships with local partners are really important. Their connection to the community can facilitate that level of dialogue.”

Ensuring that project results are built to last

Sustainability projects begin with an expiration date, but with regulations urging sector-wide progress reporting, farmers should not be left unsupported. The panel called for greater farmer involvement in strategy development and advocating for community governance to sustain initiative outcomes independently. In practice, this translates into including communities in program design, exit strategy decision-making, and transparently communicating living income efforts to clients.

One example were the farmer hubs for sustainable practices like composting and intercropping. A collaborative project led by MVO Nederland, involving Dutch brands, The Coffee Quest, Fairtrade Original, and Wakuli, went beyond pricing to identify cost-cutting and income diversification opportunities and enhance efficiencies. This initiative included training in beekeeping, mushroom cultivation, and composting, emphasising women’s and community involvement and encouraging youth to remain in agriculture. Overcoming barriers, such as persuading farmers to transition from long-standing chemical inputs, necessitates support from European business partners for access to training, initial investments for materials and financial security during the infant stages, and knowledge exchange both horizontally and vertically along the supply chain. The initiatives are supported by regionally tailored agroforestry designs to solidify the various means of income diversification.

Another shift in mindset in the project involved convincing buyers to pay premiums for quality and organic Robusta—something all of us, coffee drinkers, can start influencing in your next visit to the supermarket.

* The Lab is ran under the Chatham House Rules, which means when a meeting, or part thereof, is held under the Chatham House Rule, participants are free to use the information received, but neither the identity nor the affiliation of the speakers, nor that of any other participant, may be revealed If you’ve missed the session.